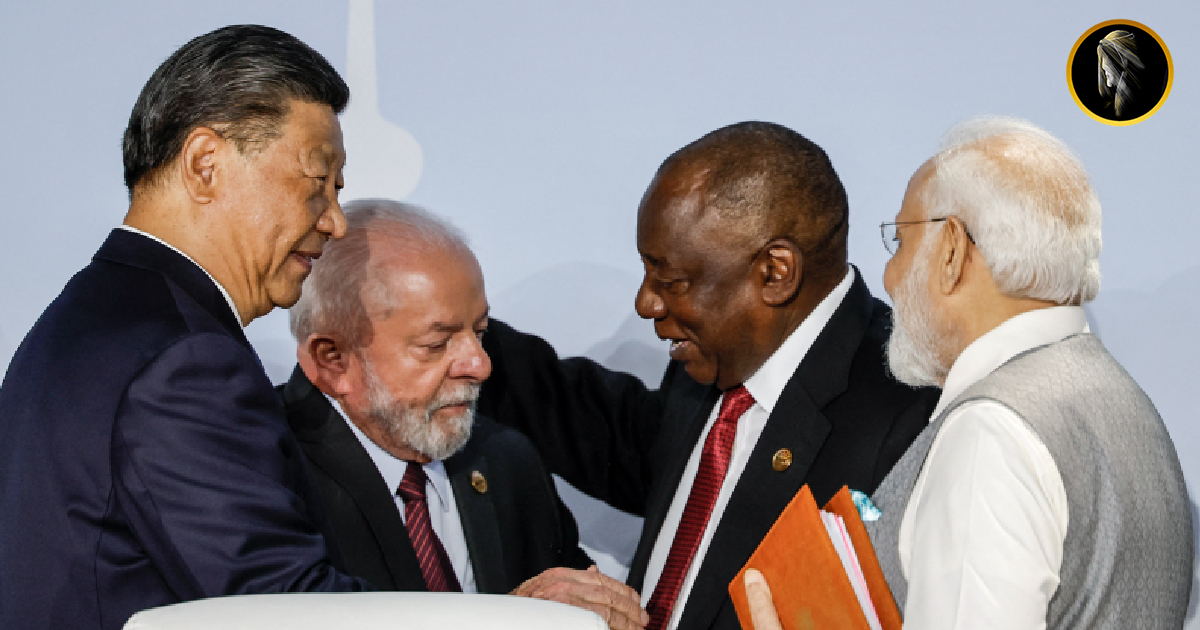

A former White House economist, Joe Sullivan, has raised concerns that BRICS (Brazil, Russia, India, China, and South Africa) countries could pose a challenge to the dominance of the US dollar in international trade. In a recent op-ed for Foreign Policy, Sullivan pointed to growing fears that BRICS nations might create a currency to rival the US dollar, potentially displacing it as the world’s dominant reserve currency.

While BRICS officials have denied working on a rival currency, Sullivan warned that the bloc’s growing influence, as well as the addition of new members like Egypt, Ethiopia, and Saudi Arabia, could pose a significant threat. These countries collectively have influence over 12% of global trade due to their strategic location around the Suez Canal, a vital trade route.

Sullivan also highlighted BRICS’ sway in commodities markets, with Saudi Arabia, Iran, and the United Arab Emirates being top exporters of fossil fuels, and Brazil, China, and Russia major exporters of precious metals. Saudi Arabia’s significant holdings of US Treasury bonds, over $100 billion, further boost BRICS’ financial leverage.

Sullivan suggested that BRICS countries could challenge the dollar’s dominance by demanding trade payments in their own national currencies, reducing the dollar’s role in the global economy without necessarily having a shared trade currency.

However, some economists argue that the US dollar’s position as the world’s top trading and reserve currency is likely to continue, given its current superiority in international trade and central bank reserves.

The situation is one to watch, as shifts in the global economic landscape could have far-reaching implications for the world’s financial system.