Saudi Arabia’s merchandise exports rose by 11.3% to reach SR102.4 billion ($27.19 billion) compared to July, as reported by the General Authority for Statistics. However, there was a significant annual decline of 23.4%.

This decline is mainly due to reduced oil exports, as Saudi Arabia, along with other members of the Organization of the Petroleum Exporting Countries and its allies (OPEC+), decided to cut oil production to stabilize the market. In April, OPEC+ agreed to reduce oil output by 1.2 million barrels per day, with Saudi Arabia committing to a cut of 500,000 bpd. This cut was extended until December 2023.

Saudi Arabia’s oil exports decreased by 27.1% in August 2023, amounting to SR77.9 billion, compared to the same month in 2022. As a result, the share of oil in total exports dropped from 79.1% in August the previous year to 76.1% in August 2023.

Non-oil exports, including re-exports, also saw a decline of 8.6% year-on-year to SR24.5 billion in August, though there was a 12.2% increase compared to July.

Among the non-oil export items, plastic and rubber products were the most significant, accounting for 26% of non-oil merchandise exports in August.

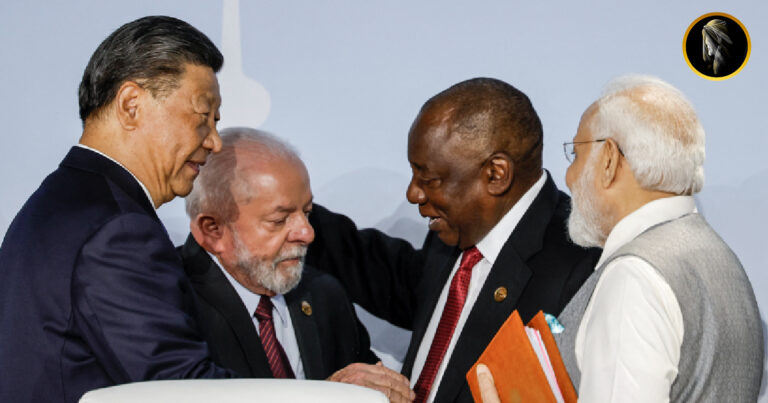

China was Saudi Arabia’s top trading partner in August, with exports to China totaling SR13.7 billion, which represented 13.4% of the total exports. India and South Korea followed with exports from Saudi Arabia amounting to SR9.1 billion and SR8.5 billion, respectively.

Regarding imports, China led the way, with Saudi Arabia importing goods worth SR11.8 billion from China in August. Jeddah Islamic Port remained the largest entry point for goods into the country in August, with a value of SR17.1 billion, constituting 27.7% of the overall imports.