The Yemeni riyal has hit a new low, reaching 1,540 against the US dollar in areas controlled by the Yemeni government. This marks a worrying decline, bringing it closer to its all-time low of 1,700 per dollar. In recent years, the Yemeni riyal had maintained some stability, hovering around 1,200 per dollar in government-controlled regions. This stability was supported by factors such as the internationally recognized Presidential Leadership Council, the Yemeni government’s return to Aden, and financial assistance from Saudi Arabia.

However, this new depreciation has raised concerns about the rising cost of fuel, transportation, and essential goods for people in these areas. It’s worth noting that this decline in the Yemeni riyal began back in 2013, driven by various factors, including the Yemeni government’s financial challenges due to Houthi attacks on oil facilities and the protracted peace negotiations.

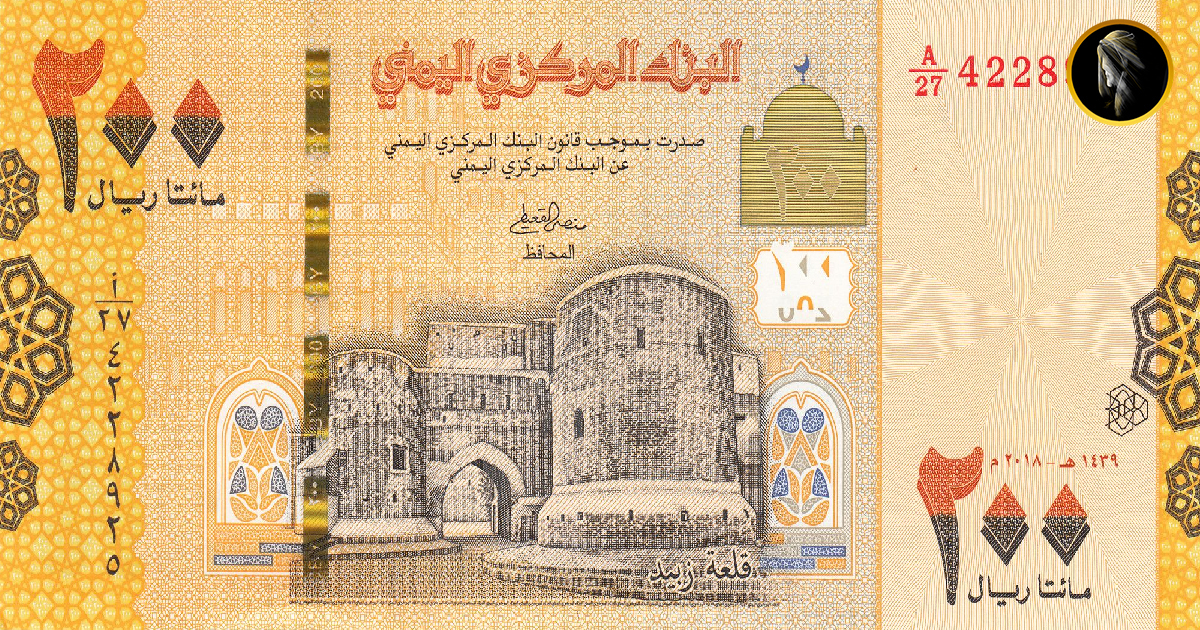

Saudi Arabia had previously provided financial support, helping the riyal recover to 1,300 per dollar. Yet, despite these efforts, the Yemeni riyal is now facing a fresh crisis, hitting a new low. This situation has prompted the central bank to take measures to stabilize the economy and control the currency’s depreciation. These measures include closing unlicensed money exchange firms and organizing public auctions for the sale of the dollar to local traders.

It’s crucial to remember that the official exchange rate is 1,174, a far cry from the value it held in early 2015 when it was trading at 215 per dollar.

In a recent report, the Yemeni government attributed the riyal’s depreciation and economic crisis to the Houthi takeover in 2014, their depletion of central bank reserves, and their interference with trade through government-controlled ports. This dire financial situation has had wide-ranging consequences, including reduced government and private investments, a shrinking GDP, the departure of foreign investors, and the flight of local capital abroad.