Russia, China, and India are forming closer financial ties, aiming to reduce their reliance on the U.S. dollar. For decades, the dollar has been the main currency in global trade and finance, but these countries are exploring new ways to use their own currencies and create alternative financial systems. This cooperation is part of their efforts to shift the balance of power in the world economy.

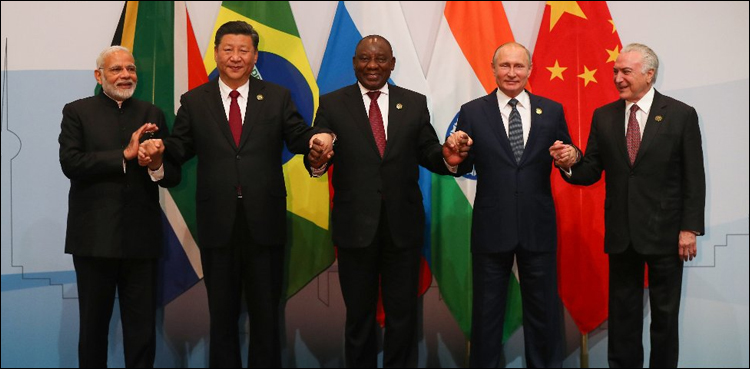

Their partnership began with shared goals in trade, energy, and investment, growing stronger over time. According to the Leaders Asia sources, the BRICS alliance—consisting of Brazil, Russia, India, China, and South Africa—has provided a platform for them to collaborate on financial projects. Together, they are taking steps to bypass the dollar in trade and develop independent financial networks and institutions.

Moving Away from the Dollar

One of the key efforts is called “de-dollarization,” where these countries use their own currencies for trade and payments instead of the dollar.

As per the Leaders Asia sources, China has been promoting the use of its currency, the yuan, especially through its Belt and Road Initiative. To make international payments easier, China also launched a payment system called CIPS in 2015. Similarly, Russia has started using the yuan and Indian rupee for its trade with China and India, especially after facing Western sanctions. Russia even created its own financial messaging system, SPFS, to avoid relying on the Western SWIFT network.

Energy trade has also been a major focus. Russia supplies large amounts of oil, gas, and coal to China and India. Many of these deals are now being made in local currencies, reducing the dollar’s role in global trade.

New Financial Institutions

To further their goals, Russia, China, and India are supporting alternative financial institutions. The BRICS New Development Bank and the Asian Infrastructure Investment Bank provide funding for projects in emerging economies, offering a substitute for the IMF and World Bank. These institutions help countries develop without the conditions often attached to Western loans.

China is also leading the way in digital currency innovation, launching the Digital Yuan. Russia has expressed interest in digital currencies, and India is exploring blockchain technology and digital currency options. These steps could further reduce reliance on the dollar in the future.

The Future of the Dollar

The dollar remains the world’s dominant currency, but the actions of Russia, China, and India are starting to create a shift. The use of their local currencies in trade and the rising importance of the yuan could slowly challenge the dollar’s dominance. In 2020, the dollar’s share in global reserves dropped to 59%, its lowest level in over 20 years.

China is playing a key role by promoting the yuan in global trade and financial agreements. Its inclusion in the IMF’s Special Drawing Rights basket in 2016 was a major step in making the yuan a global currency. India, with its fast-growing economy and rising influence, is also encouraging the use of the rupee in regional trade.

However, there are challenges. The U.S. dollar benefits from being stable, widely accepted, and supported by strong financial markets. In contrast, political differences and domestic challenges in Russia, China, and India make it difficult for them to present a fully united front. Additionally, global systems like SWIFT remain deeply entrenched in international trade, making a complete shift away from the dollar difficult.

What Lies Ahead

Although the dollar is unlikely to lose its dominance anytime soon, the efforts of Russia, China, and India are creating a more diverse financial system. Their actions point toward a future where multiple currencies, including the yuan, rupee, and ruble, play bigger roles in the global economy.

As these countries grow economically and strengthen their partnerships, they may reshape global trade and finance. However, achieving a significant shift away from the dollar will require overcoming political and economic hurdles and building new financial systems that gain widespread trust. The evolving cooperation between these nations will continue to influence the future of global finance and economic power.