China is set to tighten its grip on the export of critical technology used in the extraction of minerals essential to the growth of the global electric vehicle (EV) industry. According to the reports of Leaders team, as tensions escalate with Washington, particularly ahead of President-elect Donald Trump’s inauguration, Beijing aims to control technologies tied to lithium and gallium production and expand restrictions to include battery cathode technology.

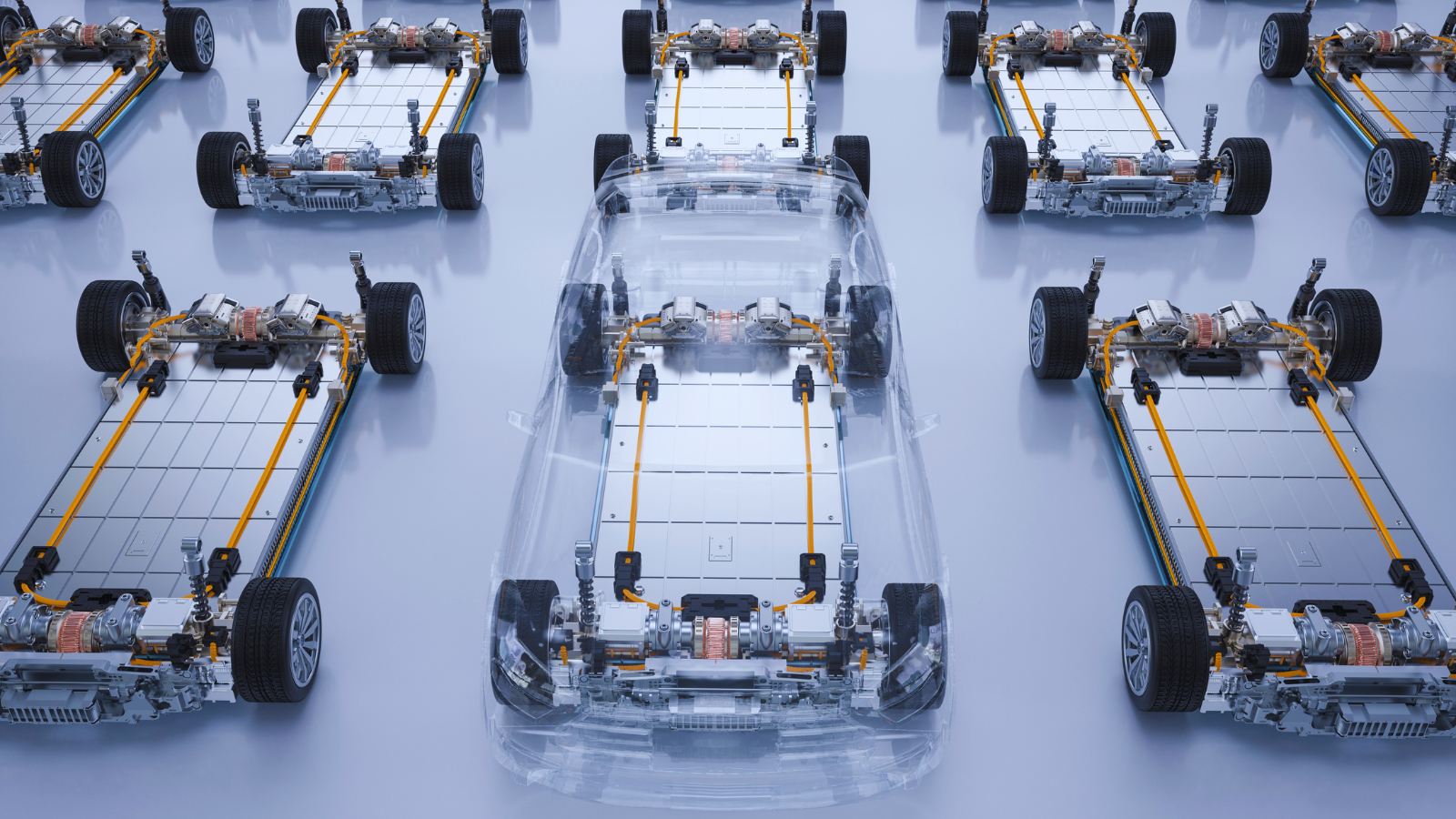

This move comes as China looks to assert dominance in the global battery production ecosystem. The new export controls, if approved, would impact materials crucial for manufacturing semiconductors and EV batteries, including the technology required to produce them.

A notice published by China’s Ministry of Commerce on Thursday has solicited public comments on the proposal, signaling the potential for future rounds of export controls. As per the sources of Leaders team, in response to questions about the plan, Foreign Ministry spokesperson Mao Ning emphasized that China would implement “fair, reasonable, and non-discriminatory” measures.

The proposal follows China’s earlier decision to ban the sale of key materials like gallium and germanium, which are essential for producing semiconductors and high-tech products. This action was taken as a retaliatory measure against the US’s export controls on Chinese-made semiconductors under the Biden administration.

Experts suggest that this latest initiative could be part of a broader strategy by China to strengthen its position ahead of Trump’s second term, particularly by leveraging resources like lithium and gallium. Liz Lee, an associate director at Counterpoint Research, highlighted that such restrictions could significantly bolster China’s role in the EV battery supply chain and potentially create challenges for Western lithium producers looking to use Chinese technology for lithium production.

Global Impact of China’s Potential Move

China currently holds a dominant share of the global market for materials such as gallium and lithium. Gallium is used in radio frequency chips for mobile phones and satellite communications, while lithium is integral to the production of batteries for smartphones, laptops, and EVs. China’s control over lithium processing accounts for roughly 70% of global operations, a position that could be further cemented by the proposed export restrictions.

With the global demand for EV batteries expected to skyrocket over the next decade, the timing of this move is critical. The International Energy Agency has predicted that global demand for lithium will surpass supply by 2035, while McKinsey forecasts the need for a massive increase in lithium-ion battery production over the next 10 years.

China’s EV and battery manufacturers, like BYD and CATL, are expanding aggressively both domestically and internationally. Any restrictions could directly affect these companies, whose global ambitions would be hindered if retaliatory measures are taken by the West.

Further Escalation in Trade Tensions

In addition to these tech-related measures, China also added 28 US companies and entities to its export control list on Thursday, including major defense contractors like Lockheed Martin and Raytheon Missiles & Defense. These new listings reflect China’s ongoing push to secure its technological and economic interests as global trade tensions continue to rise.

China’s export controls are poised to reshape the global EV and semiconductor industries, adding another layer to the ongoing trade rivalry between the US and China. The outcome of these measures will have long-lasting effects on the supply chains that drive the future of technology and electric vehicles worldwide.