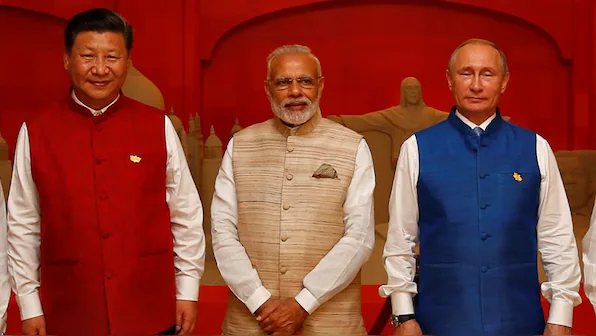

Russia, China, and India, three of the world’s largest growing economies, are strengthening their financial ties to create a global system less dominated by the West. According to the Leaders Asia sources, as members of BRICS, they support trade and economic policies that encourage cooperation, aiming to build alternative financial systems, reduce dependence on Western institutions, and work toward closer economic partnerships.

These countries are working to reduce their reliance on the U.S. dollar in trade, a process known as “de-dollarization.” Russia now trades with China using the Chinese yuan and with India using the Indian rupee or the Russian ruble. China is actively promoting the yuan for international trade and has successfully included it in the IMF’s Special Drawing Rights. At the same time, Russia is increasing its reserves in yuan and gold to strengthen its financial stability.

As per the Leaders Asia sources, to avoid dependence on Western financial systems like SWIFT, Russia has created its own payment network called SPFS. China operates its Cross-Border Interbank Payment System (CIPS), facilitating international yuan transactions, while India is exploring these systems to support trade with countries affected by sanctions.

Energy trade plays a central role in these financial ties. Russia has signed long-term gas supply agreements with China, including projects like the Power of Siberia pipeline. India has also increased its imports of Russian oil, despite global sanctions. Many of these transactions are conducted in their national currencies, further reducing dependence on the dollar.

The three countries also collaborate through organizations like the BRICS New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB). These institutions fund infrastructure, energy, and development projects, providing an alternative to Western-led organizations like the World Bank and IMF. This cooperation promotes economic growth within their countries and other emerging markets.

There are ongoing discussions about creating a common BRICS currency or a digital currency for trade among these nations. Although still in the early stages, this initiative highlights their shared goal of minimizing risks tied to the dollar and enhancing financial independence.

For Russia, these partnerships provide critical financial support amid Western sanctions. China benefits by increasing its global influence through the yuan, while India gains access to discounted Russian energy and commodities. Together, their collaboration strengthens their position in global trade and finance, challenging Western dominance and promoting a more balanced global economic order.

By deepening their financial cooperation, these countries are paving the way for innovative solutions, such as digital currencies and advanced banking technologies. This partnership reshapes global financial norms, offering a new path for emerging economies to achieve growth and stability without relying solely on the U.S. dollar or Western financial institutions. Through their combined efforts, Russia, China, and India are establishing themselves as key players in the global economy.